Superannuation Payment Deadlines & WorkCover Key Dates

Many early tax return lodgers were disappointed this year as the average refund dropped over $430 compared to last year.

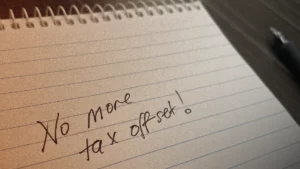

Feeling Disappointed with Your Recent ATO Refund? You’re Not Alone.

Many early tax return lodgers were disappointed this year as the average refund dropped over $430 compared to last year.

Thankyou from KP Partners

Factor1 and KP Partners are so humbled and honoured to be named finalists in the 2023 Australian Accounting Awards.

The Australian Federal Budget 2023-24

Key points to take away from the Federal Budget for 2023-24. Here are some important things about taxes and retirement savings from the Budget that can help people and businesses plan their finances.

Digital signing now available at KP Partners

Now at KP Partners & Factor1 Accountants, we’re excited to introduce the DocuSign option to sign your tax returns and financial statements securely.

How will the end of the Low and Middle-Income Tax Offset affect your tax liability or refund?

Without the offset, your tax bill will be higher this year, resulting in a higher tax liability or a lower tax refund during tax time.

Grants to help affected Primary Producers in Victoria

Two available grants: the Victorian Primary Producer Flood Recovery Grant and the Victorian Rural Landholder Grant.

30% Super Tax on Balances Exceeding $3 Million from 2025

As of 1st July 2025, earnings from super balances exceeding $3 million will increase to 30%.

Single Touch Payroll (STP) Phase 2

Single Touch Payroll (STP) Phase 2 is an expansion of the ATO’s payroll reporting system, where you’ll be required to report additional information and clarify the payments you make to your employees.

On the Money Archive

-

On The Money | March 2020PDFOn The Money | March 2020

-

On The Money | June 2020PDFOn The Money | June 2020

-

On The Money | July 2020PDFOn The Money | July 2020

-

On The Money | December 2020PDFOn The Money | December 2020

-

On The Money | March 2021PDFOn The Money | March 2021

-

On The Money | June 2021PDFOn The Money | June 2021